FinTech Leveraging UX in the Middle of Everything

FinTech, also known as Financial Technology, is derived from a combination of two words, “Finance” and “Technology”. It refers to the type of tech that works towards automating and enhancing the use & delivery of financial services.

The financial sectors, including Banking, insurance, real estate, and investment funds, are employing tech to enhance, modify and automate the financial operations and processes for businesses, companies, and users alike.

Trends in FinTech 2022

FinTech is a multifaceted concept that includes everything from straightforward mobile payment apps to complex blockchain networks housing encrypted transactions. It simplifies financial transactions for consumers or businesses, making them more accessible and cost-effective. It is being further enabled by companies using AI, big data, and even encrypted blockchain technology to expedite secure transactions among internal network(s). By eliminating potentially unnecessary steps for all the parties involved, FinTech strives to streamline the entire transaction process.

How Does Design Make FinTech Stand Out?

In a world of experience, the most effective way for a product to stand out from the competition is to provide a delightful customer experience. The design plays a massive role in it. The UX (user experience) is based on several factors, UI (user interface) being the key factor. Modern consumers value experience over things.

Between Q1 2019 & Q1 2021, 4.7 billion people installed financial apps worldwide. Amidst such cut-throat competition, how do you stand out? It requires much more than mere tech innovation. Users want solutions that are user-friendly, next-gen, and high-tech, and hence your product vision should be customer-oriented.

Utilizing UX research services can be instrumental in understanding user needs, pain points, and preferences to create a truly user-centric FinTech solution.

FinTech has managed to move past the traditional approach and its barriers and has moved in the direction of treating design the way it should be – as a key differentiating factor.

FinTech UX: Industry Use-Cases

Let’s look at how different fintech products with outstanding UX design have made managing money, investing it, and raising funds easier and smarter.

- Personal Finance Apps UX

According to research, over 63% of smartphone users use at least one app that can help them keep track of their individual spending. These fintech apps allow users to become more aware of where their money is going and, ultimately, become more financially conscious.

For instance, Mint, a widely used FinTech app, provides users with multiple predefined personal expense categories. The users need to simply link their accounts to the application and set up a limit for each category. Hereafter, the application tracks all transactions automatically and sends notifications to the user whenever they are close to the set threshold.

![]()

![]()

- Mobile Banking and FinTech UX

A good FinTech app must be functional, easy to use, comprehensive, and reliable – all at the same time. While building a FinTech UX design, a designer must ensure that he combines various consumer needs into one consistent user flow.

Considering all these factors, Bank of America came up with a great solution in the form of its FinTech app by including a virtual assistant, Erica, in the UX design. Erica, just like iOS’ Siri, provides virtual assistance and is capable of completing some simple tasks on its own, like checking account balance.

- Stock Trading Apps UX

In trading apps, a user-centered design is of utmost value. Such a design should allow users to view and analyze stats and situations in real-time, for example, change in the price of a stock. Apart from this, it may also include features where the users can find and read relevant news, develop their own investment strategies, and whatnot.

One of the better examples of this kind of app is Robinhood, it offers good usability and is extremely user-friendly.

![]()

![]()

- Mobile Payments UX

Mobile payment has become an extremely popular alternative to traditional money transfers. Nowadays, people make all their payments using their mobile phones – be it for online transactions or offline.

ApplePay is one of the best examples of such mobile payment apps.

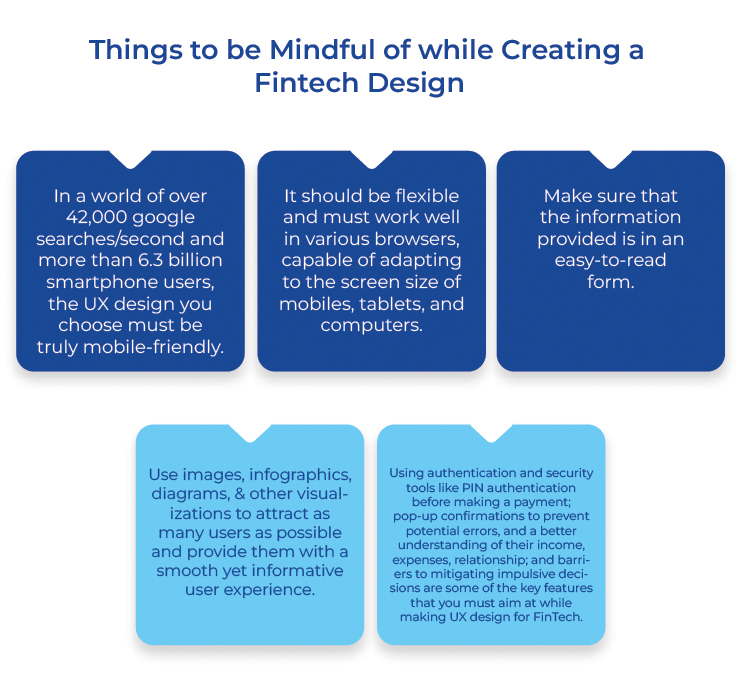

Designing fintech products requires more than just great UX/UI skills— you need to understand finance too. Designers who understand finance and know how to protect users’ valuable assets will definitely be in demand. Here’s what designers need to know to get started.

Closing Thoughts

Fintech is, without a doubt, a complex industry. It requires trust, transparency, and innovation. Designing for FinTech is no less than an egg dance for the team working on the project. This FinTech app needs to present a lot of data clearly and consistently in the most creative manner possible.

The silver lining here is that by entrusting this task to an experienced partner, you are more likely to achieve all these goals.

After going through the recent trends, it can be safely said that FinTech is definitely in the middle of everything, and a great UI/UX design services makes it that much more usable, helping it to stand out.

How Can Worxwide Assist You?

Do you want to increase your potential customer base but do not know what and how to do it? Stress not!

Worxwide Consulting is a digital growth consulting firm (Experience Design and Digital Innovation) and via products like WorxRemotely too. Being a UI/UX design company allows us to better alter and transform your product’s UX in a manner that will make you connect to new clients while retaining the existing ones. We help companies with end-to-end product design or UX design services that include research, strategy, design, and test product designs and prototypes. Worxwide based out of US, UK, and India offering bid consulting, sales transformation, user experience and customer experience design services.

Want to know more and get your queries clarified? Reach out to us HERE.

tx, USA

London, UK

India