The client

A leading Indian financial institution committed to delivering innovative banking solutions tailored to our clients’ diverse needs. With a focus on excellence and integrity, we provide comprehensive banking services spanning personal, corporate, and institutional banking sectors. Their mission is to drive financial inclusion, foster economic growth, and empower individuals and businesses to achieve their financial goals with confidence.

The problem

Users struggle to comprehend the entirety of a complex process and their current position within it, leading to confusion and frustration. The lack of clarity hampers their ability to navigate efficiently, hindering their progress and diminishing their overall experience. This issue necessitates a solution that enhances user understanding and provides clear guidance throughout the journey.

Lack of clear step-by-step guidance

Users struggle to understand the complete account creation process on the Yes Bank portal, leading to confusion about what steps they need to take and in what sequence.

Absence of progress tracking

Users are unable to track their progress during the onboarding journey, resulting in uncertainty about where they stand in the process and how much more is left to complete.

Inadequate user interface clarity

The user interface design of the Yes Bank onboarding process lacks clarity, making it difficult for users to navigate seamlessly and locate essential information about account setup steps and requirements.

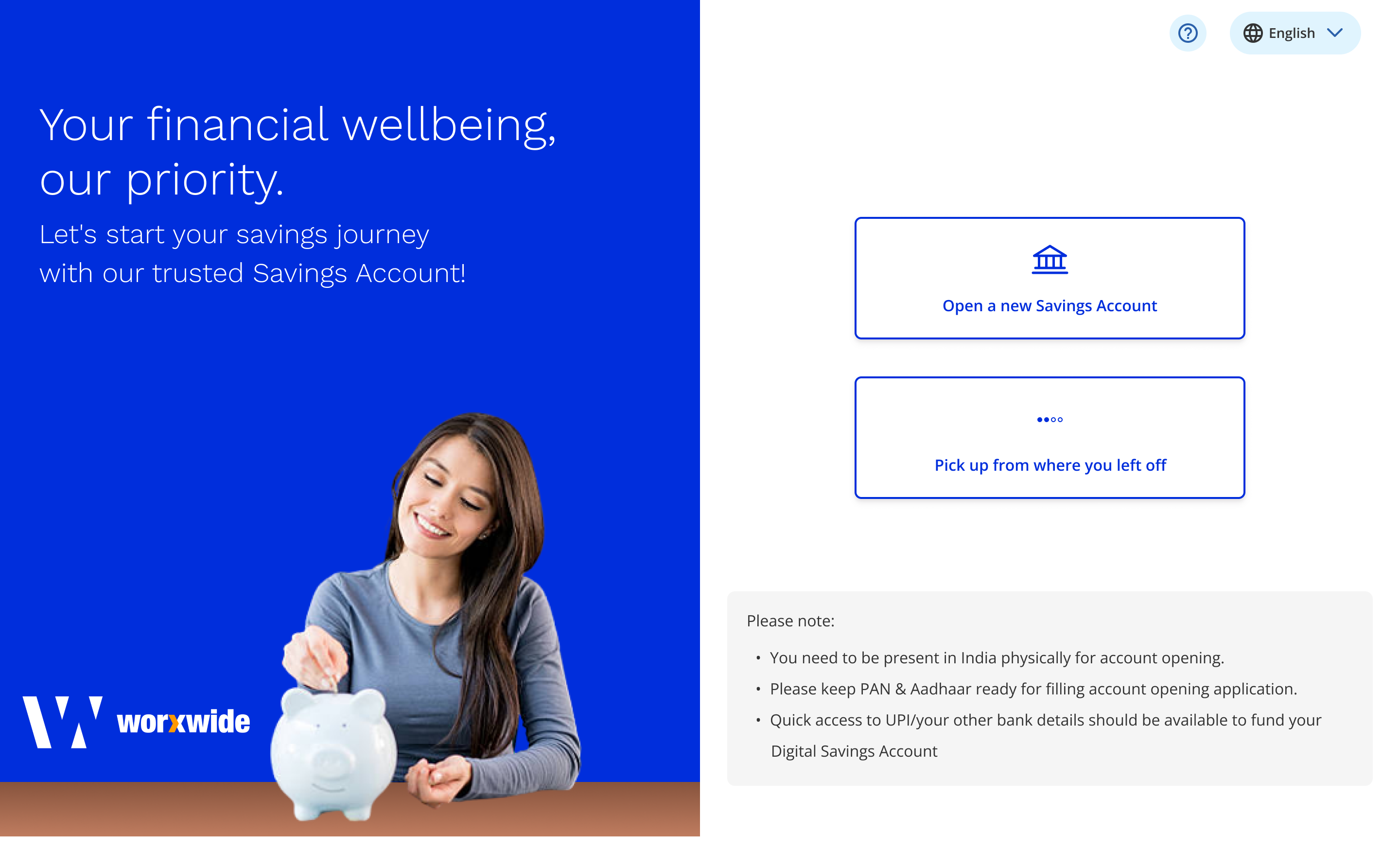

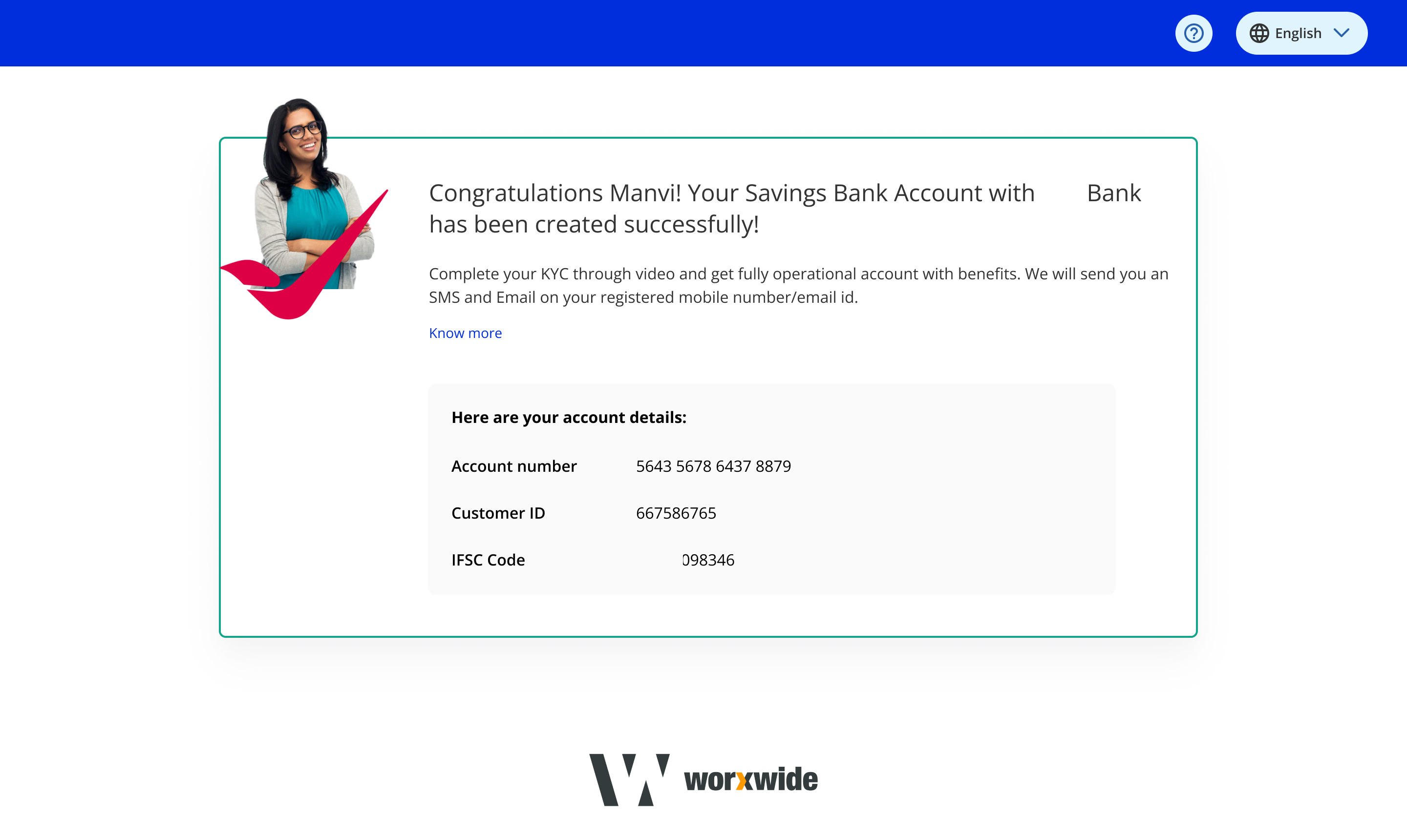

The solution

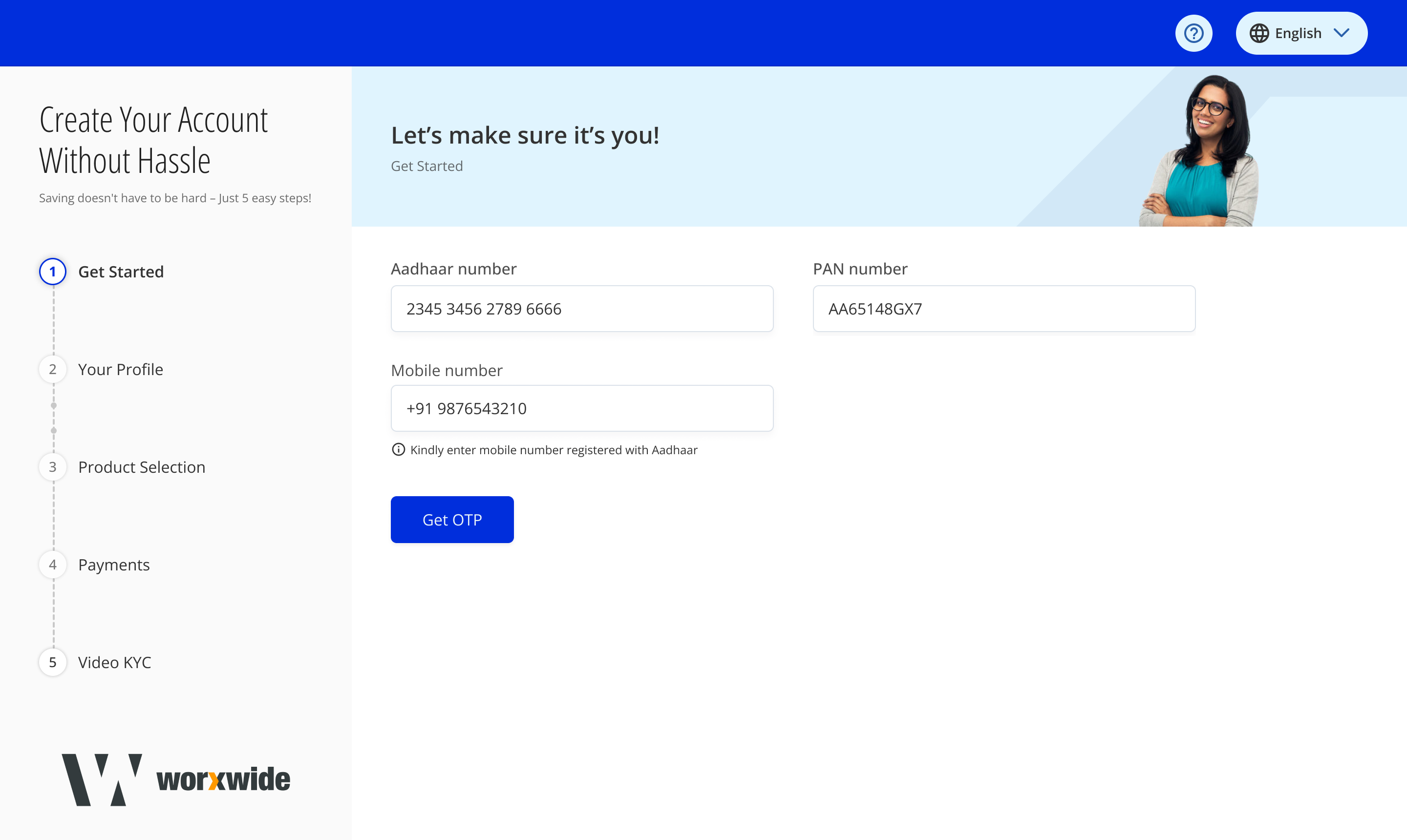

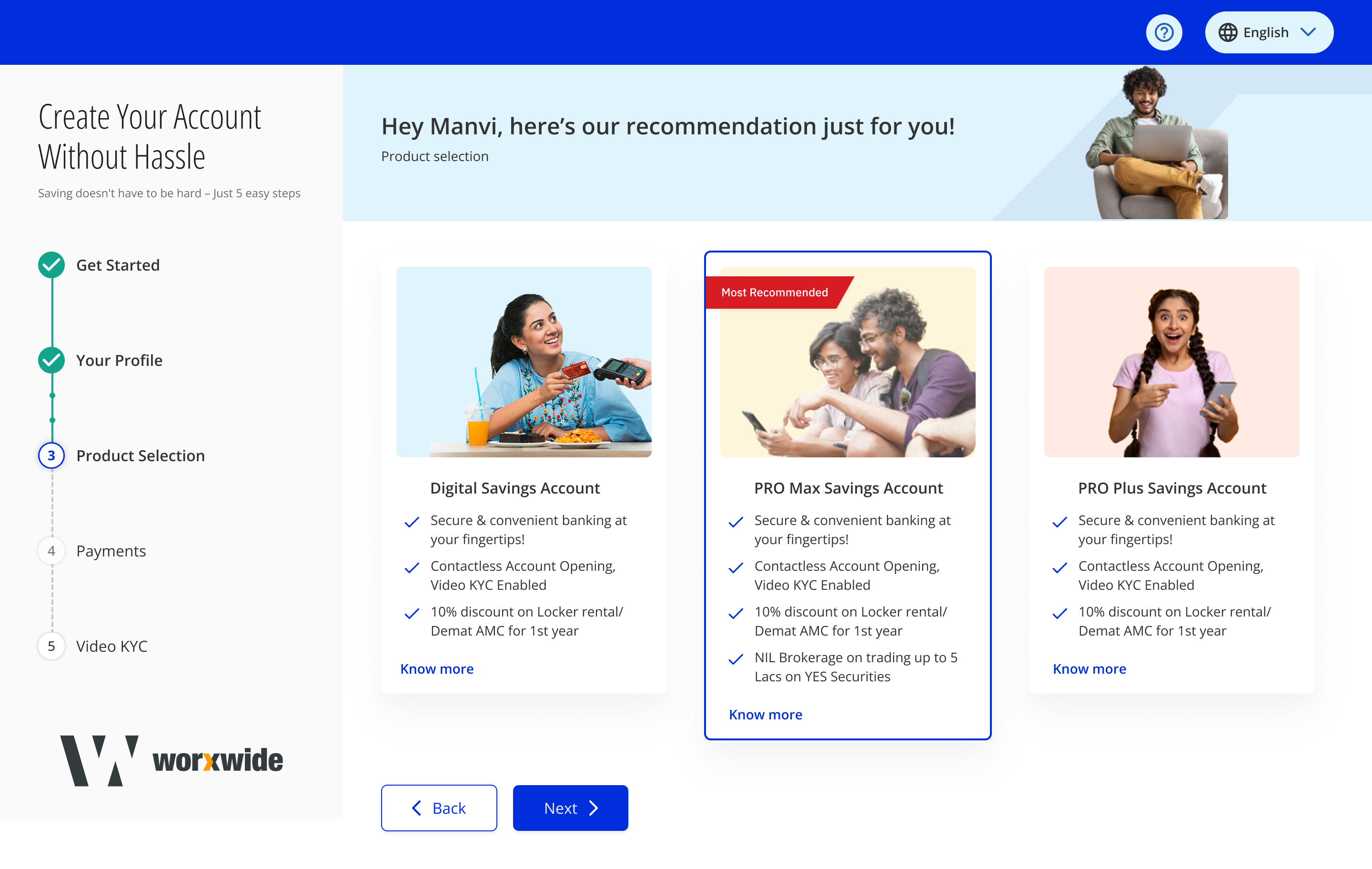

The implementation of a comprehensive onboarding program tailored to the specific needs and preferences of new users, facilitated a seamless onboarding experience. We’ve integrated status tracking features, allowing users to monitor their progress effortlessly. Additionally, users can choose their preferred language for a more personalized interaction. These enhancements ensure user satisfaction, efficient navigation, and accessibility, contributing to a positive user experience.

Guidance for new users

Enhanced the onboarding experience for new users on the Yes Bank portal by providing clear guidance at each step of the account creation process.

Status tracking

Incorporated status tracking features to keep users informed about their account setup progress, reducing abandonment rates and fostering a positive user experience.

Language Selection

Incorporated language selector to cater to users of diverse regions of India

Reduction in user abandonment rate

Implemented strategies to mitigate the instances where users abandon their interactions with the bank’s digital platforms or services prematurely.

20% new users

We saw a 20% increase in user onboarding after the revamp.

40% reduction in time to value

On comparing the before and after results we found that 40% users reported reduced time to value.

tx, USA

London, UK

India