The client

A mid-size insurance brokerage firm in the US, the client operates as a digital insurance brokerage. Their platform aims to be the one-stop solution for all the needs of an insurance agent, from potential candidates showing interest in becoming an agent to processing their clients.

The problem

The average age of insurance agents in the US is 58 years. To attract millennials to the industry and train them effectively, the rigid industry setup needs adjustment. Many young millennials lack exposure and guidance, resulting in prospective agents dropping out or becoming captive agents. Despite aspiring independence, becoming an independent broker proves challenging due to high costs and complex product requirements.

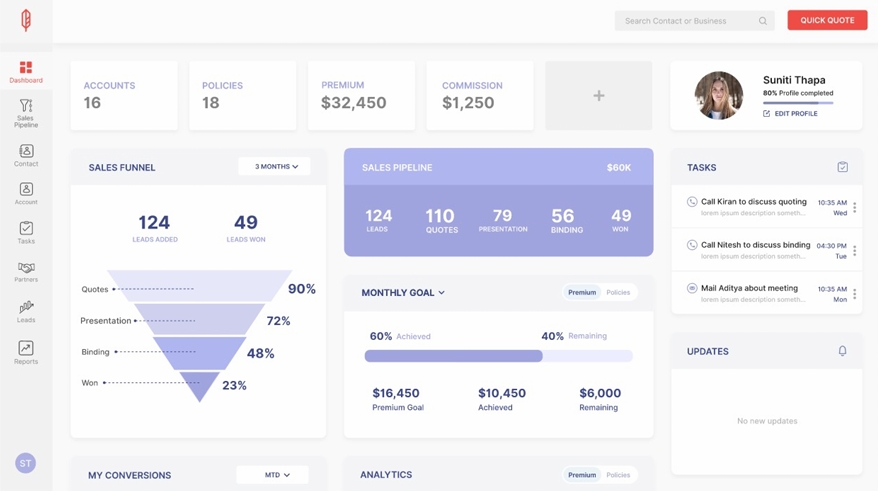

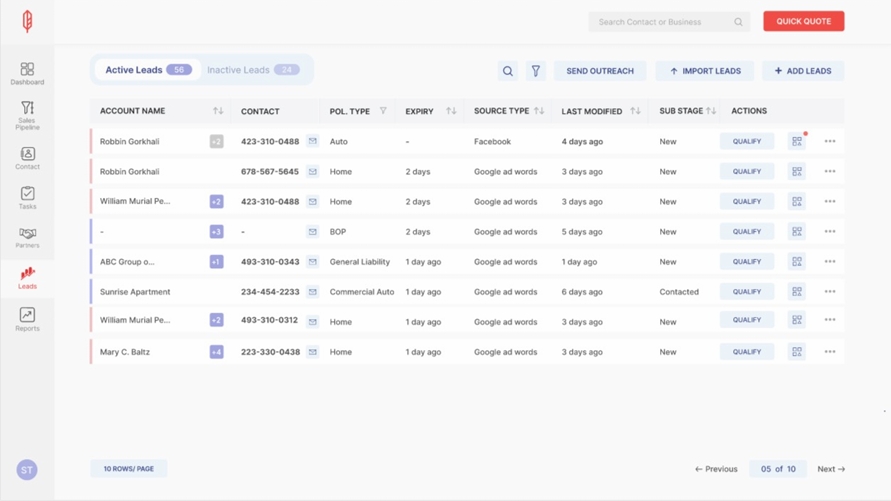

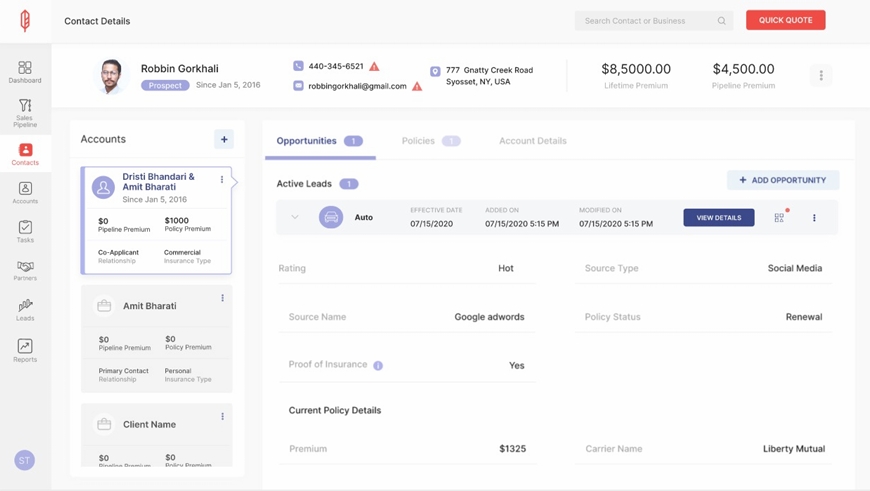

No Unified Product Experience

The agents manually tracked their clients, applications, and servicing details, often having to consult multiple sources to obtain information for a single client.

Captive Agents

US agents often work for a single company, limiting their product knowledge. Transitioning to independence involves a learning curve to familiarize with new products.

Millennials see Insurance as Boring

A primary reason why Millennials are not joining the industry is their perception of it not being lucrative and the job being boring.

Independent

Agent would want to work as independent agents provided that their transition is smooth and they increase their book of business.

The solution

Created a cohesive ecosystem for pre-licensing exam platform from training, onboarding and client management using design thinking and gamification. The size of this project meant that there was a long timeline and had different touchpoints. We started off by understanding and talking to stakeholders, insurance agents, millennials, and listed down the opportunities and the gaps. From ecosystem maps, CJMs, heuristic analysis, competitor product analysis, prototyping we showed how from a single product we could create an experience that helped all the users enter seamlessly in any part of their user journey and use the product.

Training Tool

The tool trains individuals in insurance, prepares future agents, and exposes them to the company’s product ecosystem through gamification.

Onboarding CJM

The team revised the onboarding process, reducing friction during joining, and automated it with gamification for enhanced efficiency and engagement.

Plug and Play Tool

A product needed to be built that could be used by the agent to track their insured details, lead outreach, binding policies and promotions etc.

Quantitative Impact

The average age of learners coming through the training system to the quoting tool was reduced to 40 with a higher retention average than the previous iteration.

Gamification

The process from training, on-boarding to finally working has seen better user engagement that the previous iteration and lesser drop-offs.

Single Ecosystem

All products under the same ecosystem allowed the

company to organically gain agents.

tx, USA

London, UK

India